The well-known Across Health Cross-Channel Navigator harvests extensive data on HCP channel affinity with a view to optimizing the multichannel mix. In addition, we zoom in on several related topics like 3d-party channel preference, attitudinal differences, frequency, cost,…and also company performance. In the analysis below, we are presenting the EU5 company benchmark for rheumatology.

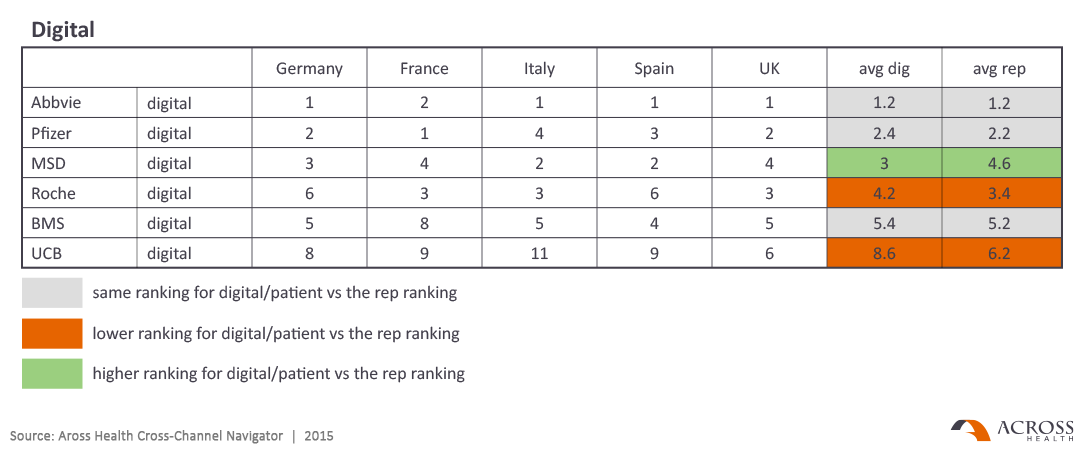

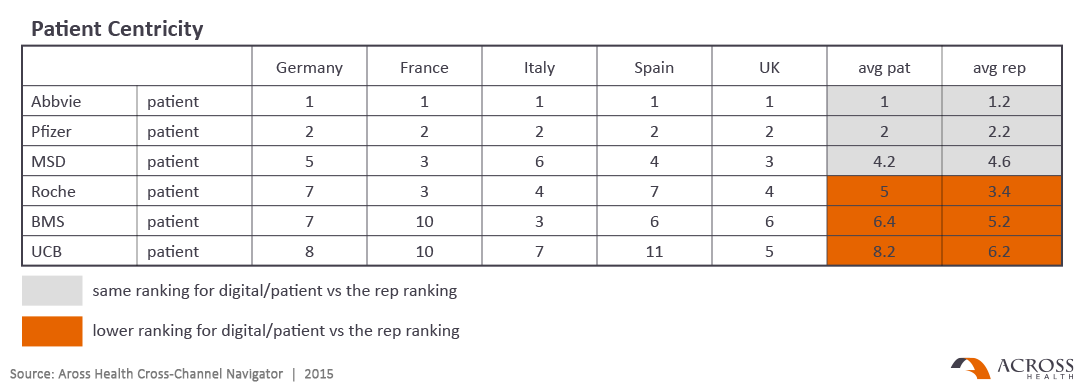

In Q4 2015, over 400 EU5 rheumatologists were asked to pick their top three companies in terms of quality of sales reps, digital initiatives and patient initiatives. We consolidated these results into an overall score and rank for each of these services. We then also compared these with the average ranking for the “gold standard”, the rep. We also assume that if the patient or digital ranking is the same as that of the rep, this may not indicate true leadership in these spaces, but possibly a “halo” effect (high SOV companies may be rated high on all dimensions). We indicate such “parity” companies in grey; companies with a higher than expected ranking for digital/patient vs the rep ranking are marked in green – there is only one, viz MSD, for digital. Companies scoring lower in these areas vs the rep footprint are marked in orange.

Comparing companies across all EU5 countries led us to a number of key observations:

-

With only 1 exception (digital in France), Abbvie leads in both areas across all 5 markets

-

Pfizer is a consistent second on both axes (except digital Italy & Spain)

-

However, in both cases, these scores are very much in line with the rep footprint – the halo effect?

-

Roche and UCB lag consistently in terms of digital and patient offerings vs their rep footprint (with big differences between individual market rankings)

-

BMS is behind in terms of patient services and at par for digital (but huge swings between markets)

-

MSD is best at complementing (average) rep footprint with digital; it is the only company that achieves a “green” score, ie subindex score is much higher than expected vs rep footprint score…but also here we see big differences between markets.

This suggests there is a substantial learning curve and perhaps more importantly a strong need for more top-down initiatives…Pharma is indeed behind the curve, but customers (both HCPs and patients) are arguably ahead of it, and it takes only one player to really “get it” and move to the New Normal – and succeed in getting more customer engagement & loyalty across all markets and stakeholders in the process. Maybe it’s the second mouse that eats the cheese, but the third mouse will have little left to eat…

For more information, please contact us.