In 2017, Bain & Company stated that at least 40% of HCPs’ brand preference is attributable to customer experience factors beyond the product. Six years on, and the latest data from our new Navigator365™ Cx Benchmark research shows that it can be as high as 83% for promoters. There are (as you might expect) marked differences between disease states, but when it comes to the kind of superior experience that turns day-to-day prescribers into advocates, customer centricity is a winning strategy.

As we emphasized in an earlier blogpost, truly effective benchmarking should resist the temptation to focus only on assessing individual touchpoints or channels and should consider the holistic experience. NPS, short for Net Promoter Score, is a customer satisfaction metric that looks beyond individual interactions to measure how likely your customers are to recommend your company or brand to a colleague (on a scale of 0 to 10). Respondents are categorized according to their rating, either as Detractors (those who give a rating of 0–6 out of 10), Passives (7 or 8) or Promoters (9 or 10). As the name suggests, Promoters are typically loyal and enthusiastic customers who are not merely satisfied with your brand, like the Passives, but can help to fuel growth by referring others. By subtracting the percentage of detractors from the percentage of promoters you arrive at the NPS (passives are not counted). This means the highest possible NPS would be 100 (if all respondents were promoters) and the lowest -100 (all detractors) – an NPS above 0 means you have more promoters than detractors and is therefore considered a good outcome.

The new Navigator365™ Cx Benchmark allows for in-depth benchmarking at the brand level and includes NPS as a standard (in addition to key channels, content types, Cx attributes, frequency, recency, and CES, among others).

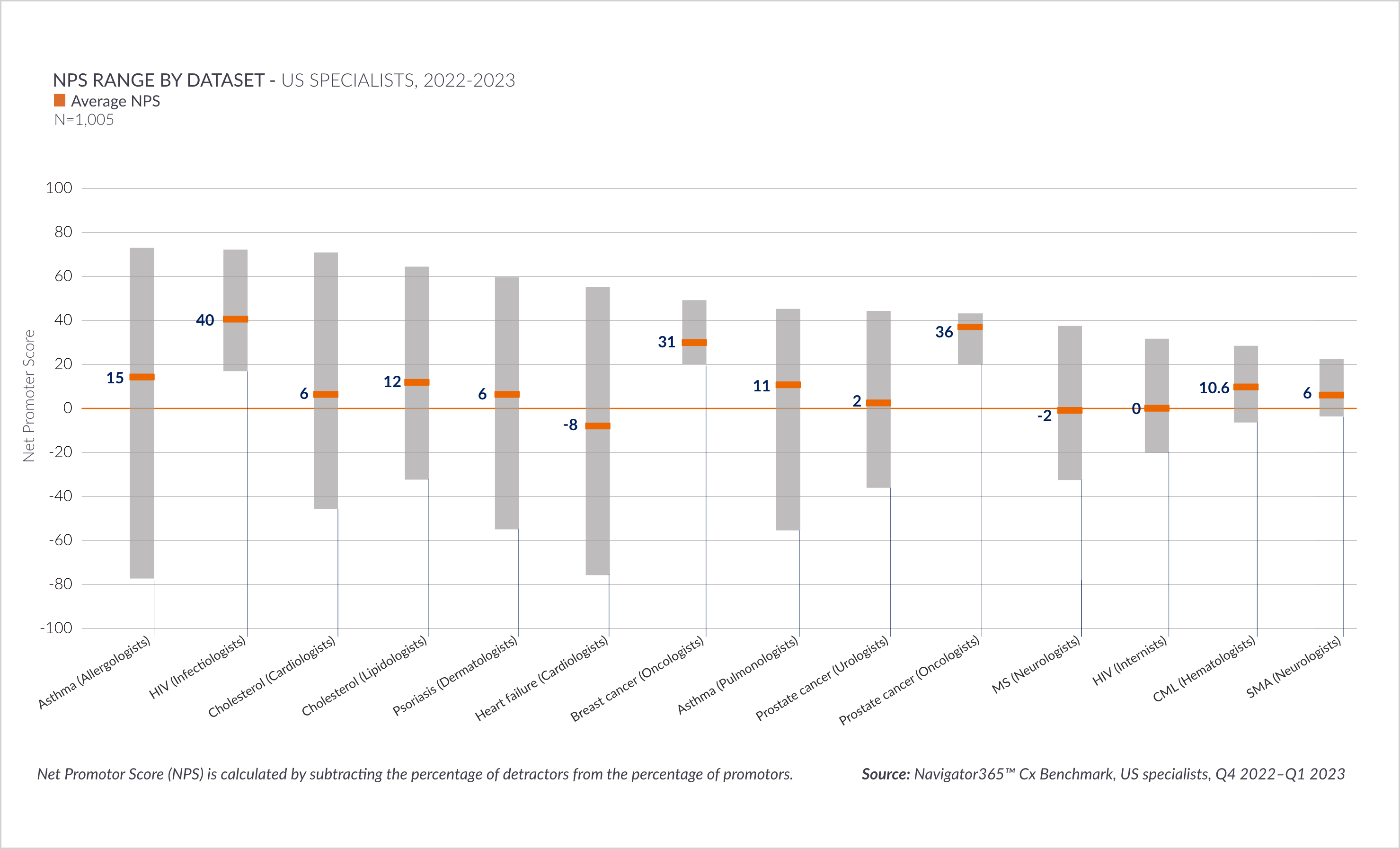

We set out to look at what drives NPS ratings given by a wide variety of US specialists by comparing fourteen Cx Benchmarks conducted in the US between Q4 2022 and Q1 2023 (n=1,005; average 72 respondents and 5 brands per Cx Benchmark report).

Range of NPS by indication and treater type

We start by plotting, for each of the 14 Cx Benchmarks, the range of brands’ overall NPS across the various therapy areas.

As you can see, all maximum NPS are positive; the average for maximum NPS is 50, with the highest score seen in Asthma (73); the lowest maximum NPS scores go to HIV (33), CML (29) and SMA (23). Between treater types, scores can vary for the same brands, with the most dramatic differences seen in HIV-infectiologist (72) vs HIV-internist (33), and Asthma-allergologist (73) vs Asthma-pulmonologist (46). For Cholesterol-cardiologist (71) and Cholesterol-lipidologist (65), the maximum scores are similar. Averaging all the minimum NPS we get -28 – only three of our Cx Benchmarks have a minimum NPS that does not dip below zero: HIV-infectiologist (18), Breast cancer-oncologist (21) and Prostate cancer-oncologist (20). Since scores can therefore vary strongly not only between indications but also between treater types, benchmarking should take this into account.

Cx as an NPS driver

So how can you strengthen your NPS? Should you focus on brand-related factors or on Cx? Or both?

As part of Navigator365™ Cx Benchmark, we also ask HCPs whether how they rated the brand was influenced mostly by Cx or by the brand’s attributes (or both). And with one exception (which we’ll discuss in a moment), we see that the higher-scoring participants – both passives and promoters – tend to attribute their rating to Cx-related factors (defined as: high-quality omnichannel engagements).

In heart failure, for instance, 83% of brand promoters state that their score was mainly driven by Cx; the average across all 14 benchmark surveys is 70%. Since promoters tend to prescribe significantly more than passives, the difference between an “OK” and a “great” experience – one that might bump a passive score up to a promoter score – has the potential to have a large effect and therefore represents a significant opportunity.

If you look at the NPS drivers for detractors, the picture is almost the opposite – on average only 44% say their low score is driven by Cx factors with most linking instead to brand attributes (drug characteristics such as efficacy and tolerability, etc).

There is one outlier, however: in breast cancer, poor Cx drives detractors' scores, and you could assume a similarly higher need for a better Cx in our two other hemato-onco indications: prostate cancer and CML. Could this be because these physicians are more heavily (and indistinctly) targeted by promotional messages, while at the same time being well informed already, making them less forgiving of bland, non-personalized product messaging? At the same time, we see lower NPS for older brands that are losing out to the new kids on the block in terms of product superiority and have reduced or even stopped completely their engagement efforts – a double whammy of negative brand and negative experience.

It does make sense that Cx is less likely to have an influence if HCPs feel that the (brand) basics are not already in place. We’d go so far as to say that efficacy and other brand attributes should be at least on par with one other brand – if you do not have that, your chances of hitting a high NPS are non-existent. But once you are at that level (or close to it), you can win the hearts and heads of customers by improving Cx.

However you slice it, it’s clear that customer centricity is a winning strategy.

In addition to the company- and channel-level benchmarking insights available in Navigator365™ Core, new Navigator365™ Cx Benchmark allows for more in-depth benchmarking at the brand level.

To hear our experts advise on how robust benchmarking can support you in sound business planning, you can watch our on-demand webinar or download the webinar FAQ.

Alternatively, please reach out and we would be happy to arrange a call with one of our omnichannel experts.

%20-%20Benchmark2023%20-%20august%20-%20NPS%20score-%203%20bars.png)